How to hire the ideal bookkeeper for your small business: a comprehensive guide

अनलाइनखबर पाटी १६ पुष २०७८, शुक्रबार

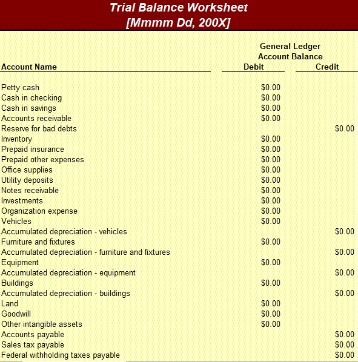

Look at budgeted balance sheet the item in question and determine what account it belongs to. For example, when money comes from a sale, it will credit the sales revenue account. Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software. When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate. Remember that each transaction is assigned to a specific account that is later posted to the general ledger.

Services offered

Accounting software can streamline your bookkeeping process and make your financial management more efficient. It’s useful for business owners looking to save time and avoid common accounting errors. Bookkeepers record and classify financial transactions, such as sales and expenses. They maintain accurate records of daily financial activities and manage accounts payable and accounts receivable. The two key accounting systems are cash accounting and accrual accounting. If your business is still small, you may opt for cash-basis accounting.

Understanding of your industry

Note that certain companies, such as those in service-based industries, may not have a lot of equity or may have negative equity. Her work has been featured on US News and World Report, Business.com and Fit Small Business. She brings practical experience as a business owner and insurance agent to her role as a small business writer. In the dynamic world of finance, challenges and issues are bound to arise. Virtual bookkeepers are adept at troubleshooting problems and finding solutions efficiently.

- Transparently discussing the financial aspects of the collaboration is essential.

- Many companies have a background check policy to run a criminal background check on all new hires.

- Decide whether you need an in-house bookkeeper or if outsourcing is a better option.

- Failing to disclose substantial liens or personal bankruptcies could be a lawful and non-discriminatory reason when directly related to the job description.

- Assess the size and complexity of your business, the volume of financial transactions you handle, and the level of expertise you require.

Debits and credits should always equal each other so that the books are in balance. Implement a system for regular performance reviews to assess ongoing contributions. Address concerns, provide feedback, and offer opportunities for professional development as needed. Regular reviews contribute to a positive and evolving working relationship.

Deciding between full-time and freelance bookkeepers

To specifically seek freelance bookkeepers, check out our top picks for online bookkeeping services. You can also use a website that’s specifically for hiring freelancers. Expand your search to additional job board sites if you want to hire an employee for the role. You want to make sure you get your job posting in front of as many qualified applicants as possible. Before you start your search for a bookkeeper, you must clearly understand what your business requires from its future bookkeeper. Assess the size and complexity of your business, the volume of financial transactions you handle, and the level of expertise you require.

Compile a list of potential bookkeepers and compare their services and pricing to make an informed decision. There’s good news for business owners who want to simplify doing their books. Business owners who don’t want the burden of data entry can hire an online bookkeeping service. These services are a cost-effective way to tackle the day-to-day bookkeeping so that business owners can focus on what they do best, operating the business. For business owners who don’t mind doing the data entry, accounting software helps to simplify the process.

Even if your company doesn’t have an office in one of these locations but you’re open to hiring someone remotely, you’ll need to comply amending your taxes be careful with irs with these laws. However, if you’re hiring a freelance bookkeeper, you may not have to consider such compliance laws—more often than not, these only apply when hiring an employee. If you’re interested in hiring a contract bookkeeper, consider Bench, a virtual accounting service provider. When you sign up, you’ll be paired with a dedicated bookkeeper who acts as your in-house accounting team. Bookkeepers are expected to do the day-to-day recording of receipts, invoices and other transactions.

These associations have directories of their members, allowing you to search for bookkeepers with specific qualifications or expertise in your industry. Online job boards and freelancing platforms, such as Upwork or Freelancer, can be great resources to find freelance bookkeepers. You can discontinued operations definition post your job requirements and receive applications from qualified bookkeepers.

As your business grows, handing over this responsibility to a bookkeeper will allow you to navigate the complexities of financial record-keeping with ease. To get this qualification, a CPB must have demonstrated proficiency in essential bookkeeping skills, including accounting principles, payroll, taxation and financial reporting. This qualification is pretty much a seal of approval when it comes to bookkeeping proficiency. Industry-specific directories can help you connect with professionals fast. TaxDome Advisor, for example, allows you to search a database of highly rated accountants, bookkeepers and tax professionals. You can view profiles, read reviews and send messages all in one place.

Leave a Reply